Introduction

hi everybody the quick Commerce wave has taken the entire e-commerce industry by surprise. what once looked like a fancy marketing gimmick of 10 minutes delivery is now the same space as million-dollar companies like Dunzo, Zepto, Swiggy, and even Zomato. Not just that even the big guns like Reliance are so Keen about the space, that Reliance has invested 200 million dollars into Dunzo, and even D-mart is slowly sneaking into this space. But on one side while this looks like a logistical Miracle on the other side as of now it seems to be an economic nightmare with all these companies reporting hundreds of crores of losses every single quarter.

In this blog today let’s try to understand

- How have these quick Commerce companies Master the logistic system to give you a 10 minutes delivery?

- How do they intend to become profitable?

- How could these quick Commerce companies go on to threaten the positions of giants like Reliance and D-mart?

Triple C of Quick Commerce Startups.

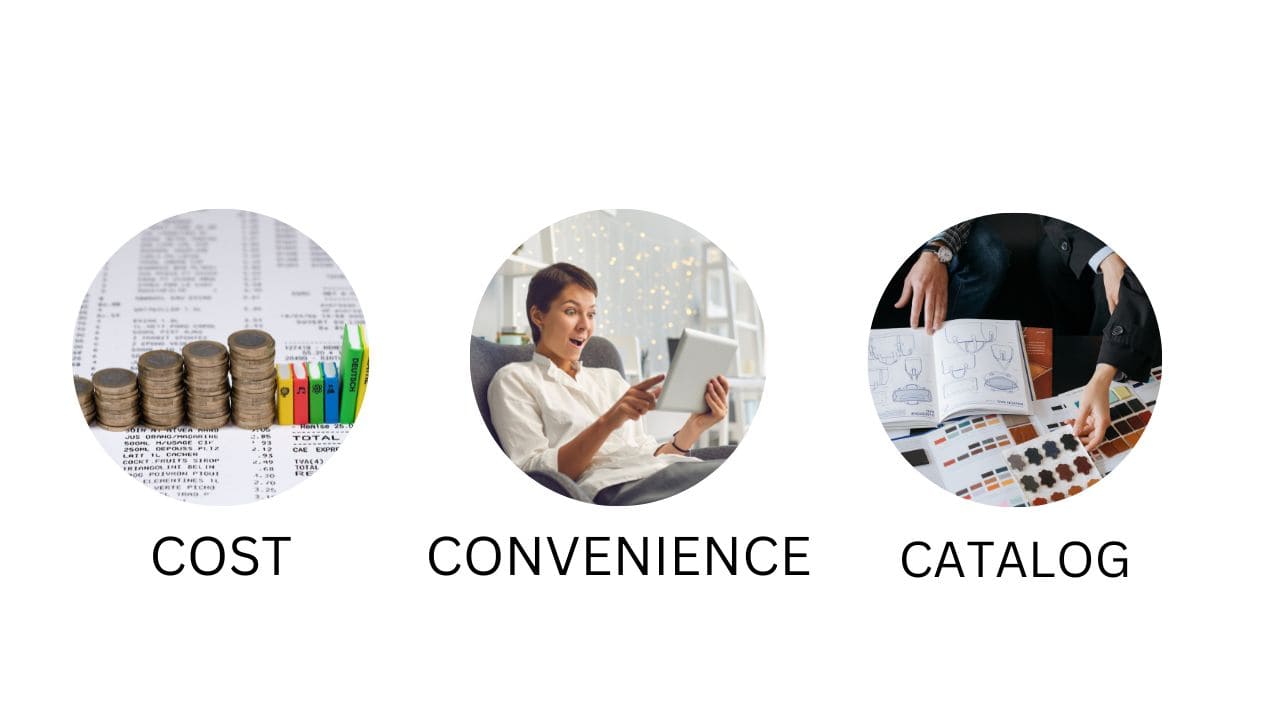

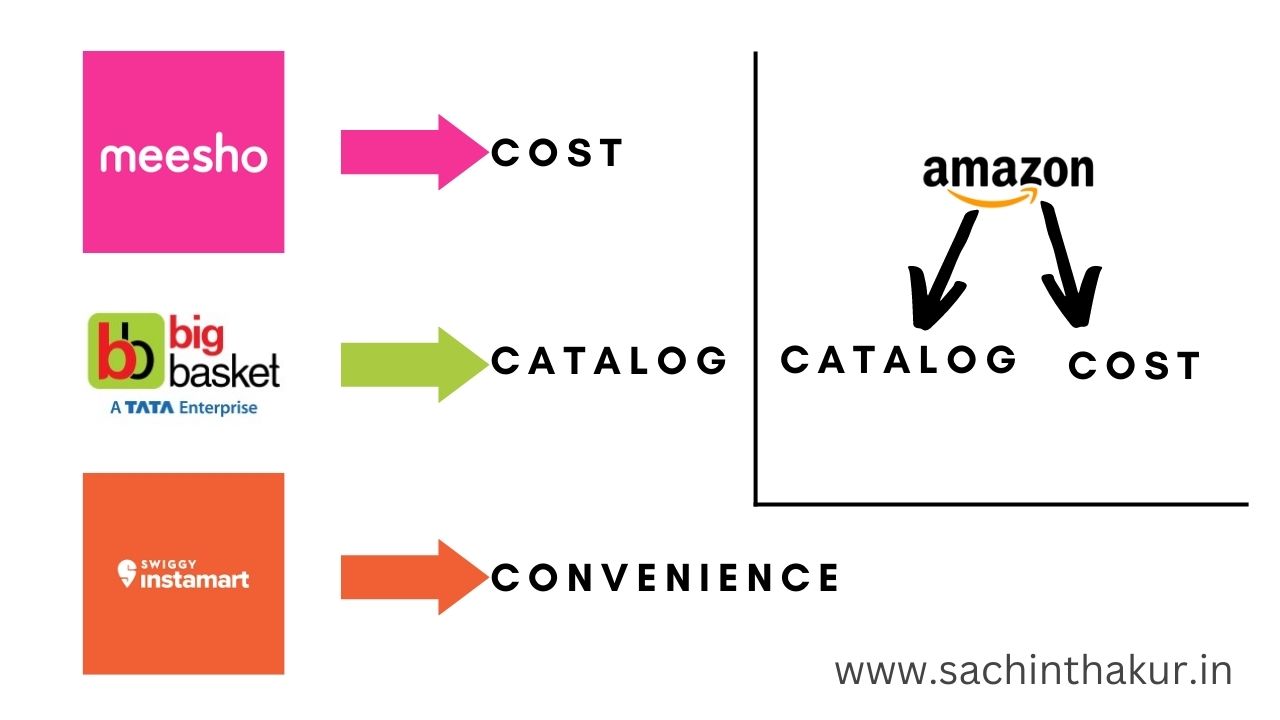

The key to understanding the quick commerce wave and the landscape of Indian e-commerce lies in this wise coining of words by Aviral Bhatnagar. Wherein he categorizes e-commerce with three words cost, convenience, and catalog.

In the race of offering one of these C’s companies are more likely to compromise on the other two C’s. So you’ll see that while Meesho offers cost, Big Basket offers a great catalog, Swiggy Instamart offers convenience, and Amazon offers both catalog and cost which is why it’s clearly one of the most powerful players in the market.

So, if you look at quick Commerce the quick Commerce game is a convenience game and you will choose to order from Dunzo even though it’s not cheaper than Dmart, even though it does not offer a vast catalog like Big Basket. Why? Because while D-mart and Big Basket might take anywhere between 4 hours to 1 day to deliver, Dunzo will be able to deliver the products in less than 30 minutes.

How are these companies able to deliver groceries so fast? And how do they intend to become Profitable?

Well, these companies use something called the dark store model and if you’ve already read about it you know that it’s nothing but a micro Warehouse, wherein you have some two to three thousand products stored. These warehouses are just like a Kirana store but they do not sell to walk-in customers and are specially designed to act as a super efficient micro warehouse.

All thanks to data analytics these tools are so strategically located that they’re as close as 1.5 to 4 kilometers away from the customer base, so as soon as you place the order with the app the logistics are designed in such a way that every single action of the delivery staff and the warehouse system are curated such that they can give you the fastest delivery possible.

If this is very clear to you let’s have a look at some numbers and see what exactly is their scope of profit.

according to this Economic Times article, it costs anywhere between 25 to 40 lakhs to set up a dark store, and a typical dark store is 2000 to 2500 square feet large it has a total of 13 to 14 staff in the store who are mostly Packers and the average order value is 350 to 400 rupees for the industry and here’s the most critical part of all the gross profit margins of these companies are anywhere between 15 to 20 percent.

What is gross margin?

It’s your total revenue minus the cost of goods and services divided by the revenue.

Gross Margin = (Total Revenue – Cost of Goods & Service) / Revenue

If you shop for 400 rupees which includes bread milk and vegetables then the gross margin is the revenue which is 400 rupees minus the cost price of the products divided by 400. so here if it’s a 20% margin then the cost of products to the company is 320 rupees and the gross margin is 80 rupees so this is pretty excellent right 80 rupees profit per order, and thousands of orders going out every single day from each one of these Dunzo stores.

So, these dark stores are practically cash machines, right?

Why Dunzo and other quick commerce are Not Profitable?

well not really because this is not net profit but gross profit margin so this 80 rupees margin does not include the indirect fixed cost like office expenses, rent, administrative costs, or even delivery costs,s and this last mile delivery is one of the most expensive cost variables in the chain because if you do the math a delivery buyer gets a salary anywhere ranging between 25 to 35,000 and on an average a rider clocks 20 to 30 deliveries a day as of now so let’s take a safe average of 30,000 rupees salary with 25 deliveries a day.

So, we have 750 deliveries a month and the cost per delivery is 40 rupees sometimes this cost could even go up to 60 rupees per order because of the inefficiencies in the delivery allocation.

But right now let’s not get into that and consider this to be 40 rupees now if you take out the 40 rupees delivery charge from a gross margin of 80 rupees we only have a 40 rupees margin left per order now.

According to money control, Pro’s research this dark store in Mumbai touches 600 orders a day so assuming 600 orders per day they would have 18,000 orders a month so with 18,000 orders in a month with a 40 rupees margin excluding the delivery charge that leaves the store 7.2 lakh rupees per month but this store has 34 employees with salaries ranging between 18 to 20,000.

So even if you take the lower limit of 18,000 rupees the salary cost itself amounts to 6.12 lakh rupees and now if you start taking out rent or installment of the place along with electricity bills, software, marketing, and maintenance

you will see that it’s very likely that this dark store is profitable so this really looks like a cash Drain.

How does Zepto & Dunzo turn Profitable?

In order to turn profitable, this variable of average order value just needs to go up by another 100 to 150 rupees and suddenly the same dark store will become a money machine.

Order Value by customers = 560

Order Per Day = 600

Order Per Month = 600×30 = 18,000

20% Gross Margin per order would be = 112 rupees

Delivery Charge = 40 rupees

Gross Margin (Excluding Delivery Charge) = 72 rupees per order

Gross Margin (Excluding Delivery Charge) = 70×18,000 = 12.96 lakh

Net Margin = 6.84 lakh

So it’s basically a game of skill this is how a dark store could actually become profitable with its given capacity and the reason why all these quick Commerce companies are racing those groceries is because

Order Frequency of Customers

you would shop for electronics probably only 10 times a year. You would shop for personal care products probably once or twice a month but you would order groceries four to five times a month and that too on a planned schedule and if this is unplanned this frequency could even go up to 12 to 15 times a month so this way

Challenge of the Quick Commerce

1) Achieve a 20% gross margin

which is extremely idealistic because if you see even a giant like Walmart has a gross margin of only 16.34 as of June 2022.

2) Achieving Peak efficiency with delivery staff

This is extremely challenging and this number that we have taken to be 40 rupees per delivery that could even go up to 60 to 100 rupees per delivery and then that order is no longer profitable.

But the challenge over here is that the delivery boys keep on leaving and joining the company so if you look at the attrition rate. The monthly attrition rate in this industry is 18% to 20% per month. So, one in every five delivery boys in your company will leave every single month.

This is the reason why they have to recruit extra delivery staff so that they could make up for the attrition and at the same time keep up with the demand, and because of this extra delivery stuff, the cost per delivery sometimes increases to 60 to even 100 rupees.

3) Achieving an extraordinary number of orders per day

Because you see guys this quick Commerce concept actually comes in the US wherein the average distance between an American house from the closest local grocer is around three to four kilometers

Similarly, Walmart is 6.7 kilometers away and Target is eight kilometers away

But you tell me how close your nearest grocery store and I bet you that 90 of you will have a grocery store in less than one kilometer and most of you would have a grocery store within walking distance from your house.

So you see Zepto is not just competing with other quick Commerce companies like Dunzo and Instamart but also with every single Grocer in that particular locality.

4) Order value Should be more than 500 rupees

As we saw in our calculations if Zepto and Dunzo-like companies want to become profitable they need to push towards having an order value of 500 plus.

But the problem over here is that market research says people use Quick Commerce apps to do unplanned grocery shopping as in if you want to make a sandwich you would just open up Zepto and Order bread sauce cheese and vegetables or sometimes people just order Coke and chips for movie night. So, with these kinds of unplanned shopping, it’s very less likely that the order value would cross 500 to 600 rupees, and at the same time if the company makes it compulsory to order for 500 or 600 rupees then again the core offering of quick Commerce which is the factor of comfort itself is defeated and this brings me to the fifth Challenge

5) Their differentiating factor from our local Kirana store

So if Zepto starts taking up more than 30 minutes to deliver because of demand you would rather order from your local grocery store because today most grocery stores would give you free home delivery.

Similarly, if they do not deliver fresh items once or twice then again the local grocer becomes more preferable.

6) Assortment of these Apps

the assortment on these apps is one of the most important reasons why it is more convenient to order via Zepto as compared to placing an order on WhatsApp to your Kirana Store, but if your Kirana store itself starts taking orders from the app.

Do you realize this Delta between Zepto and Kiran store actually starts coming down? And for this there was the app called my Kirana in Pune “I’m not sure if they’re still Functioning” but this app simply got all the Kirana store products listed on the app and you could get an Amazon-like experience while altering from your local grocery store.

So, when you place your order your local grocer gets the order and he sends his Chotu to your doorstep within 20 minutes. I’m not sure how they made money but as far as my understanding is concerned these kinds of apps actually make money by charging a subscription to the Kirana stores.

So if these kinds of apps start coming to the market they would further shrink the market share of zepto-like companies.

On top of that if the Govt. comes out with its own app or an initiative like ONDC to democratize the logistics of e-commerce then again it’s going to be a big problem so you see this game is extremely tough and the company that overcomes all these challenges will obviously go on to become a legendary profitable company who would then go on to become as big as D-Mart or Reliance Retail because of their speed and efficiency

Personal Opinion

If you ask me I personally do not believe in this quick Commerce and I just think Reliance or Dmart might just go on to buy one of these companies and turn these dark stores into a Dmart dark store or a Reliance dark store because if you look closely while Dmart and Reliance have the scale products and supply chain Dunzo and Zepto-like companies are collecting a gold mine of data into finding the most efficient last-mile delivery system. This way Dmart will be able to sell its products at a very affordable rate at the same time they’ll be able to use the dark store Network to deliver products 24X7 or maybe even in less than 30 minutes

These are the working models, challenges, and competition analyses of the quick Commerce industry and its players in India. this brings me to the last part of the blog and that are the study materials to help you understand this trajectory of the emerging quick Commerce wave of India but before we move on

References

- Money Control Pro article that throws light on the challenges and a few case studies about the operations of dark stores in India will help you understand both the economics and the operation of these Dark stores.

- Market research report on the quick Commerce industry and its growth factors

- I’m attaching a few Links

- https://inc42.com/features/hyperlocal-conundrum-kiranas-vs-dark-stores-in-indias-retail-post-covid/

- https://inc42.com/features/dunzo-blinkit-swiggy-zepto-india-quick-commerce-bubble/

- https://www.youtube.com/watch?v=-MB6FdKyJmg (Think School)

1 thought on “How Zepto/Dunzo’s Business Strategy is CRUSHING Dmart and Reliance? Retail Business Case Study”