CRED is one of the most fascinating business model case studies in the Indian start-up ecosystem. In just 2 years, CRED went from 0 to hit a $2B valuation and became one of the youngest Indian startups to reach this milestone. The peculiarity of CRED is that in 2020 alone CRED incurred a massive loss of ₹360 crores which is a massive increase of 492% from 2019. And for every rupee of revenue that CRED generated they spent ₹727 which is a massive cash burn. We all have seen the result of massive expenditure on creative marketing.

Now the question is

- Even with such massive losses. How is it that CRED is getting so much funding?

- What exactly is Kunal Shah’s strategy?

The beauty of this case study is that if you only understand what CRED is doing. You will more or less understand a large chunk of the Indian startup ecosystem. Because most of the giant companies like Jio, Ola, and PharmEasy also operate in a similar fashion. The most important factor that is common in all of them is that They extensively work on altering the behavioral design of society. And the anticipation of that behavioral design is what makes them billion-dollar companies.

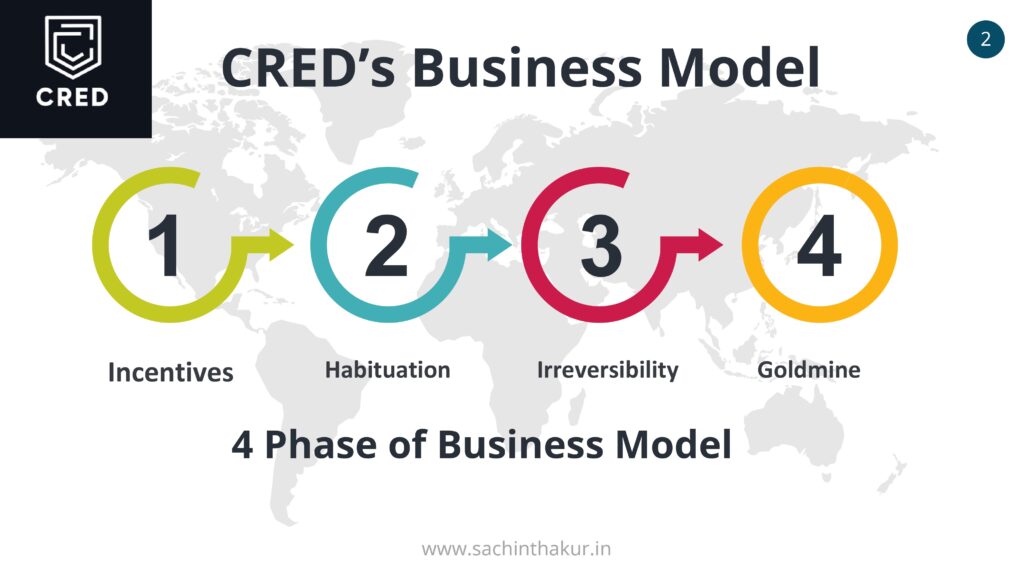

This golden strategy works out in 4 discrete Phase

- The company first identifies a major problem in the society

- It designs a system to fix that problem

- It raises a million dollars in funding

- It entices the customers to use the product by giving out unbelievable offers which are almost too good to be true.

A very simple example of the same is Jio.

First of all, Jio identified internet accessibility as a major problem in Indian society and then Reliance spent about ₹1.5 lakh crores on building the infrastructure required for Jio. And then in 2016 when Jio got launched, they gave out offers that almost looked impossible.

-free sim cards, free calls, and free internet.

And the moment this announcement happened, millions of people rushed to buy Jio sims. And Jio did everything in its capacity to maximize the number of its users without even bothering about profits. This is why, on top of the heavy investment that they made. They further incurred a loss of Rs. 31 crores in 2016.

Just like this, when CRED rolled out in 2018 they identified 3 of the biggest pains of a credit card holder which are

- Hidden charges

- Late fees due to forgetfulness

- Extra interest

They rolled out massive cash backs and offers to incentivize the act of on-time payment. And these offers were as amazing as free flight tickets extremely lucrative discounts and ₹1000 cashback also.

Fast forward to 2021, CRED today has over 30 lakh users. Today, CRED is already processing 20% of all premium credit card transactions.

Phase 1 (Incentives )

So this is how within a short span of time, in Phase 1, companies present incentives in order to get customers to use their product, eventually, to increase their user base. And this is what brings us to Phase 2.

Phase 2 (Habituation)

Phase 2 is all about habituation. Once you bought a Jio sim, you never bothered about talk time, you never bothered about data. And we all recklessly got habituated to this newfound luxury of the Internet.

Similarly, in the case of CRED, the people who have 2-3 credit cards found it so simple to use CRED that they stopped using their conventional method wherein they had to go through this long list of their statements or put in the effort to dig in and find out whether there are hidden charges, on each credit card

As a CRED user myself, I can’t even tell you how amazing it feels compared to having this terrible feeling. Wherein you have no idea where the hell your money is going. In fact, there was a time when I thought that some hacker is stealing my money, alright? and I’m not even kidding about this.

So, this is how in Phase 2, using their super efficient system companies seamlessly get us habituated to the new normal. Wherein we are no longer used to adjusting to the ‘hurdles of the system’.

Here’s where we enter the most crucial phase of all, that is, Phase 3

Phase 3 (Irreversibility)

Phase 3 is what we can call Irreversibility.

A classy example of the same is Google Maps. Now you might have observed that most of the people of our generation never even bother to remember the name of a landmark, street, or chowk. In fact, I’ve got so used to Google Maps that in my own city, if you leave me in some street I will start wandering as if I am in some strange jungle. That is how much I have got habituated to Google Maps. And by the way, this does not include those superhumans who have this amazing memory to remember any route, even if they have visited that place only once.

And you know which friend am I talking about… 🙂

So the point is, Google Maps has made our lives so easy that finding a way to a place no longer occupies our headspace and in the case of CRED, users no longer have to remember to pay their credit card bills, they no longer have to remember when exactly is their due dates or bother about late fees.

Similarly, in the case of Ola, we are no longer used to finding taxis on the streets. In the case of Jio, when there is no Internet you all know how you feel.

So you see, once these companies came in there has been an irreversible change in our behavior wherein the small acts of booking a cab or paying a credit card bill has changed to such a large extent that we will never ever go back to our past system.

Now CRED is yet to complete this phase which is why all the numbers that you see about CRED are in the negatives now because CRED is yet to change a significant part of consumer behavior.

Phase 4 (Goldmine)

Now, this is the goldmine that every investor waits for wherein the company starts making profits and if you look at the numbers, it literally looks like a goldmine.

For that matter look at the numbers of Jio.

In just 1.5 years, Jio became profitable that is in the 3rd quarter of 2017 with a profit of ₹504 Crores. From there onwards it has been on a magnificent run. Wherein in 2020, Jio posted a net profit of ₹5,562 crores.

And the reason why CRED is also sitting on a similar goldmine is that the customers of CRED are by default the richest 1% of the country. These people are literally the dream customers of any company. Their incomes are high, so they make expensive purchases on a regular basis.

Which results in massive profit margins for every company. And my sense is that in the 4th phase, CRED could leverage its golden customer base in three very-very powerful ways.

How CRED will leverage its golden Customer

1. CRED could become this must-have expense management app which will also allow its users to file their income tax and just like it cured the headaches of credit card users by saving their money from hidden charges.

CRED might also start saving its customers a ton of money through their income tax rebate filings by turning the entire process of income tax filing into a very simple and efficient process. If this happens, I don’t think any of us will ever leave the CRED club.

2. CRED has one of the most valuable customer data in terms of purchase preferences.

For example, CRED clearly knows that

Parsh loves to spend ₹20,000 on sports.

Ganesh loves to spend ₹10,000 on education and books.

So CRED could use this data to show relevant advertisements with exclusive coupons to get people to spend heavily on the things they absolutely love eventually, to make a commission out of it.

3. CRED could also become a bank for the top 1% of India. The reason why I think so is that there are two important factors that are very-very crucial for any bank’s existence.

2 reasons why CRED could become a bank for the top 1% of India

- Every bank wants customers who have a lot of money deposited in their bank account after all their investments and expenses. And this money is what the bank uses to lend to businesses and customers in the form of home loans, car loans, etc.

- Every bank needs borrowers who pay back their loans judiciously. So that they can charge interest on top of it eventually to make money out of the lending business.

CRED literally has these exact people in its customer base which is why my sense is, CRED could literally extend itself to become a full-fledged bank or maybe even become a full-fledged portfolio management system for the top 1%. Eventually, it become the most revolutionary fintech start-up in India.

So to put that straight, for ordinary people like you and me CRED might look like a weird idea but in reality, it is a revolutionary idea coming from one of the most amazing entrepreneurs in the Indian start-up space.

Do you know How HDFC Bank Business strategies killed the monopolies in India?

Conclusion

We must consider ourselves to be extremely fortunate that we are getting to witness their processes and we must learn from these revolutionary start-ups that are going to redefine 21st-century India forever.

If you learned something valuable from this article please comment below.

I’ll be very grateful if you share the article with your friends, colleague, and co-founders.

Thank you so much!

FAQ

What is Cred Business model?

CRED Provide a platform for Credit card users to pay their credit card bill. The uniqueness of this app is that this app shows all hidden charges and gives cashback and offers on paying credit card bills. They also make it simple to pay credit card bills through their app.

Listing Fee

Cred Sell the product on their app and charge a fee to the third parties company as Listing Fee of Products.

Data Monetization

Cred Collect Financial data so Cred knows who is able to return the loan and who can not. A financial institution has a very big demand for this type of data so these Financial Companies can provide loan to people who can return

How CRED make money?

CRED Make money through third-party companies who list their product on the CRED app to sell. These third-party companies pay a fee to CRED. Cred also has various other products like

Cred Pay – Cred pay provide instant payment. Created with partnering Razorpay.

Cred Stash – Cred Stash is a personal Lending Platform. This platform provides lending solutions online.

Cred Store – Cred store is a platform where you can buy anything. Whenever you pay credit card bills you receive coins that can be used for availing various offers and discounts.

Cred RentPay – Tenants can pay their Rent with Credit Card with this product.

is Cred Profitable?

No, Cred is Not Profitable yet in 2022.

Overall expenses surged 2.7X, and CRED’s losses soared 2.4X to Rs 1,279 crore in FY22.

Pingback: Content Marketing Lessons from Red Bull, FORD and Garyvee's book Crush it

Pingback: Boat Case Study - How Aman Gupta's MARKETING STRATEGY turned Boat into a 1500CR Company - SachinThakur.in

Pingback: HDFC Bank Case Study | Marketing strategies of HDFC - SachinThakur.in