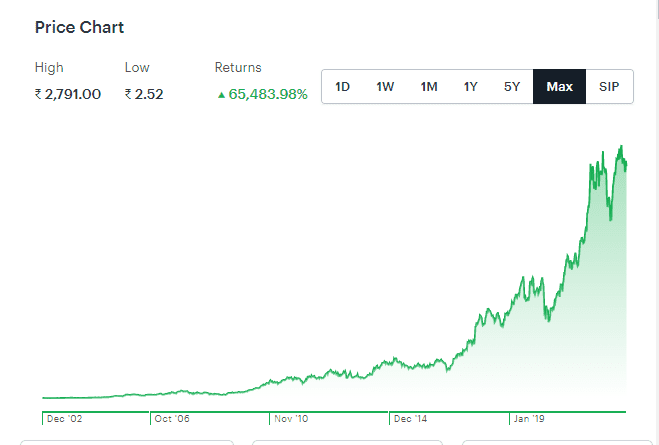

Tanishq is one of the most incredible brands in Indian business history. In the past 20 years, the stock price of its parent company Titan has shot up by not 10% not 20% but 33,000% going from just 7.11 rupees to 2700 rupees. A mere 10,000 rupees invested in titan 20 years back would be worth a minimum of 35 lakh rupees now.

Although Titan has a lot of brands under its canopy the jewelry division alone accounts for 75% of its total business. As of 2021, Tanishq generated a net sales of 20,600 crores. And today it is one of the biggest jewelry sellers in the country.

The question is:-

- How did Titan turn Tanishq into such a huge brand?

- What were the business strategies that enabled them to disrupt the orthodox gold market of India?

- What are the lessons that we need to learn from this case study?

Story of Tanishq

This is a story that dates back to the late 1980s. By this time it had been four to five years since the Titan brand had started and as we saw from the Titan article Mr. Desai and his team had built an incredible company for the Tatas in Tamil Nadu.

After cementing Titan’s position in India in the 1990s Mr. Xerxes wanted to take Titan to the European markets. However, this proposition did not take off at all.

Why?

Because the European watch market was crowded at all levels at the lower end they had local brands, in the middle they had Japanese companies like Seco, and then at the top, they had swiss brands. So while sales of west Asia and Asia pacific were good the Europ business was incurring losses. And eventually, that division had to be shut down.

But, suddenly Titan decided to sell jewelry in Europe.

Now the question is:-

Why would a watch company suddenly start selling jewelry and that too in Europe?

How Titan started selling jewelry

Well, that is because something crazy happened in the middle east during that time. The United States had recently invaded Iraq over Saddam Hussein’s invasion of Kuwait. In the build-up of the invasion, Iraq and Kuwait had been producing a combined 4.3 million barrels of oil a day.

But when the war tensions started rising. It led to the 1990s oil shock. Wherein the price of oil shot up from just 21 dollars per barrel at the end of July to 46 dollars per barrel in mid-October. And this put nations all across the world in deep deep trouble.

In the case of India, since India imported oil and paid for it in dollars or forex, the high prices caused a significant burden on our forex resources by June 1991.

India had less than one billion dollars of foreign reserves left which was just enough for three weeks of inputs. This was a situation even after substantial borrowing from the IMF. So during this time, any company that wanted forex had to generate it completely by itself. In simple words, India said if you’re a businessman who wants dollars don’t come to India for exchange because we need to buy oil. If you want to do any kind of import earn or borrow dollars from someone else and then spend it completely by yourself.

Now in the case of Titan, they needed dollars to import their watch components so they started swelling jewelry with the goal that they would make and sell jewelry in Europe earn forex then use the money to import watch components then use those components to make more watches in India and then sell them all across the world.

But this is when liberalization came into effect in India in 1991. As a result, India’s I.T. companies like Infosys and Wipro started bringing an enormous amount of forex. Eventually, the oil shop faded away and Titan started focusing on the Indian market under a different brand name.

This is how another iconic Indian brand was born which we all know today as Tanishq.

Why Mr. Desai and the team pursue the jewelry market in India

The reason was that while visiting a jewelry exhibition at the Taj Hotel they made three important observations.

- The Indian household was extremely passionate about jewelry because it was an investment and not an expense and even an orthodox family did not mind spending tens of thousands of rupees on jewelry.

- But secondly, the jewelry designs in India were extremely mediocre and the purity of gold was quite questionable this was because impurity was a very good way for the local jewelers to expand their margins and make a ton of profits.

- In spite of having such an enormous demand and a customer lifetime value in lakhs, the margins in gold were extremely high because of both appreciation in value and more importantly because of cheap labor.

This is what propelled Titan to enter the jewelry business.

Now by the look of it considering the fact that Titan had the cash for the Tatas and the expertise to get world-class tech. It looks as if it must have been easy to crack the jewelry market of India. Well not really in fact Tanish in the initial few years was a loss-making unit and at one point in time the condition was so bad that they were in talks of selling it off. This happened because of two major reasons.

- The Indian jewelry market was very very strongly established with unorganized players why because the only jeweler’s Indian families trusted were the local family jewelers. I say local and family because if you ask your parents they’ll tell you that even your grandparents and their siblings bought from the same jeweler.

- Then 22 karat gold was the de facto standard. This is where you’ve got a product with 91.6% percent gold and 8.4% alloys. But Titan started out with 18-karat jewelry. This was because the 18-karat was sturdier would not get scratched easily and would give a firmer grip to the gems and stones. This way they could focus on innovative designs with started jewelry.

But in India back then and even today design was secondary and proportion of gold was primary. Why, because gold for Indians was an investment and not just a piece of jewelry. So, the weight of gold, the weight of diamonds, making charges, and appreciation value all of it mattered to the Indian buyers and they didn’t mind a simple design as long as it had more gold.

This is when Mr. Xerxes and his team decided to introspect Tanishq very very closely. So, immediately the pricing system was changed. The price tags now display the gold and the gem details that explain the price of each product to the customers and overall the focus shifted from design to purity and value.

Karatmeter (Game changer for Tanishq)

Tanishq made a game-changing investment into something called the Karatmeter. This investment completely changed Titan’s game forever. To tell you about it most families in India trusted one family jeweler who had been selling them gold and other jewelers for 20-30 long years.

But at the same time Tanishq understood that these jewellers were adulterating the products by a large extent and that a common man can not actually differentiate these intricacies. This is also something that you cannot just tackle with marketing campaigns.

This is where the Karatmeter came in. Karatmeter was an important machine from Switzerland that actually used spectroscopy to measure the purity of gold. This machine was installed in all Tanishq outlets. After that Titan launched a special campaign. Wherein they invited customers to walk in with any piece of jewelry and measure its purity for free.

Now since gold was very very important to Indians, people actually flocked to these stores to check the purity of the ornaments that they had actually bought from their family jeweler out of blind trust and the majority of these people were shocked to discover that they had been cheated by their family jewelers for decades.

This was because the gold was not as pure as the jewelers claimed and when lakhs of people felt betrayed or dissatisfied with their jewelry Titan deployed another strategy called the 1922 strategy.

1922 Strategy

In this scheme, women could bring in their gold jewelry and test it in the karatmeter and if the purity of the jewelry was lower than 22 karat and higher than 19 karats it could be exchanged for Tanishq 22 karat jewellery of their choice by paying only the manufacturing charges and Tanishq could bear the cost of gold, yes you read that right Tanishq could bear the cost of gold.

This was Titan’s customer acquisition strategy.

Now although it might look like Titan was draining cash by paying for the gold. what we miss out on is the fact that when it comes to jewelry the customer’s lifetime value goes to lakhs of rupees. If done right just like local jewelers you could be looking at customers from three to four generations of the family. As a result, when this 1922 strategy was executed Titan was very cleverly able to uproot the blind trust of the local jewelers and acquired a lack of customers from all across the country.

This is how Tanishq laid the foundation to build its brand as a synonym of trust and purity.

And the result will be 2002-2003 the jewelry division’s operating income increased from 267.66 crores to 345 crores with profit before tax at 5.37 crores.

This is where Tanishq rise as a blockbuster brand began because it tackled one of the most important batteries of customer acquisition and that is the barrier of trust. This is when they further moved ahead to tackle the second barrier which was the barrier of cost.

After the karatmeter strategy, Tanishq found another gap in the market for expansion. They realized that because of their branding efforts, the middle-class Indian family started to perceive Tanishq as a brand that was too expensive for them. And from the cost standpoint a middle-class family that wanted to purchase gold could not shell out 6 to 7 lakhs at once.

But at the same time, the desire to buy the set was there. Because after all, it was an investment. This is where Tanishq launched the famous gold harvest investment scheme to buy jewelry.

Gold Harvest Investment Scheme

In this scheme, if you wanted to buy a gold chain worth 2.4 lakhs and you didn’t have that kind of money. You could actually deposit 20,000 rupees per month for 11 months with Tanishq. And then Tanishq would pay your 12th installment of 20 000 rupees.

At the end of the year, you would have 2.4 lakh rupees to buy your gold chain. This is almost like a S.I.P. for gold. If you didn’t want to buy gold after a year you could get the money back with a discount voucher for the additional amount.

This is how the barrier of the cost was brought down. As a result, Tanishq became more accessible to the middle-class population of India.

And eventually they tackled yet another important barrier which was the barrier of cost.

And lastly what we love about these classic brands is that they often consider one factor that no other brand considers in order to identify intricate gaps in the market and this is the factor of empathy.

Mia collection and Zoya collection

In this case, Tanishq actually observed that working women didn’t want to wear very ornate jewellery to work. Because it looked too flashy. At the same time, they wanted something affordable, elegant, and easy to wear.

So Tanishq launched the Mia collection that specifically addressed this segment of the audience and started their pricing from 3999 onwards. Then they also found that the richest people in society who had the purchasing power wanted to buy unique designs which would distinguish them from the crowd. So they launched the Zoya collection that starts from 70,000 rupees and goes all the way up to 70 lakh rupees.

Then they also saw the digital wave rising. So Titan invested in Karatlane 2016 which is an online jewelry company.

In fact even today if you go out in the market and you try to examine the competition of Tanishq you will see that there are very very few brands that actually cater to so many categories of audience. Like Executive, Ultra rich, Traditional, Minimalistic, Designer, etc.

This is how Tanishq evolved to become one of the largest jewelry sellers in the country.

Lessons from Tanishq’s market strategy

- First Lesson:- There is a thin line between what you think your customers like and what they actually like. So always do your market research thoroughly before stepping into the market. And the most powerful way to do that would be to study the data and then go and talk to people to understand the story behind the data. The point we noted over here is talking to people is more important than analyzing data.

- Second Lesson:- Sometimes you have to make people aware of the problem before providing the solution. In this case, although people are buying impure gold the blind trust of the local jewelers needed to be broken in order to establish the informed trust Tanishq. This is where Titan’s Karatmeter came in handy.

- Third Lesson:- Always remember empathy is that superpower that can turn a commoner into a king. In this case, the constant market assessment done by the Tanishq team gave them million-dollar assets in the form of mia and Zoya collections. So always remember to keep updating yourself about what your customers need otherwise they won’t need you tomorrow.